The OS for Modern Due Diligence

Run diligence data, workflows, collaboration, and reporting in one system.

20,000+ firm network. Enterprise AI. 5x ROI

Trusted by 250+ client teams at allocators, asset managers, ManCos and fund service providers

Why DiligenceVault?

Reduce diligence cycle time by up to 60% from request to response.

Too Many Requests. Too Many Formats. Too Little Time.

Manual diligence doesn’t just waste time, it increases risk, inconsistency, and decision blind spots.

The Network Data Advantage – From Chaos to Order

Combine AI with one of the world’s largest diligence networks not fragmented and stale data.

From Diligence Fatigue to AI-Powered Intelligence

No more chasing, no more wasted time just smarter, faster decisions. So you can focus on what truly matters!

High quality diligence data sourced directly from the largest fund network, and combined with AI-extraction layer

Simplified investor reporting for managers by maintaining a live Blaze profile which feeds bespoke DDQs / RFPs requests

An enterprise-grade AI customized for unique diligence workflows to deliver scale and auditability

A secure platform designed specifically for asset and investment management diligence workflows

For Allocators

A central repository of fund data and AI-powered diligence workflows for manager research, ODD, legal, compliance, ESG and finance teams.

Data Collection

Powerful digital diligence engine with a network of 20,000+ responding firms across public markets, alternatives and private markets managers.

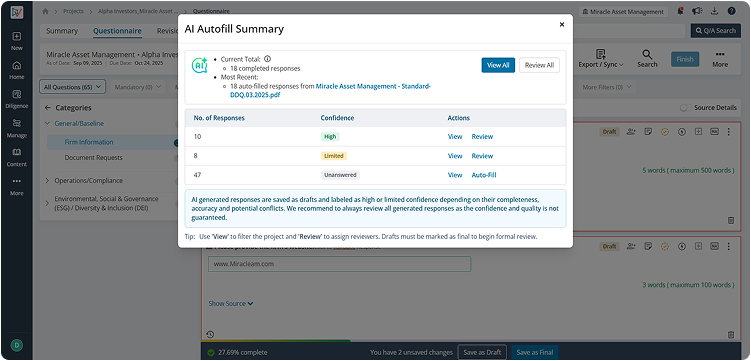

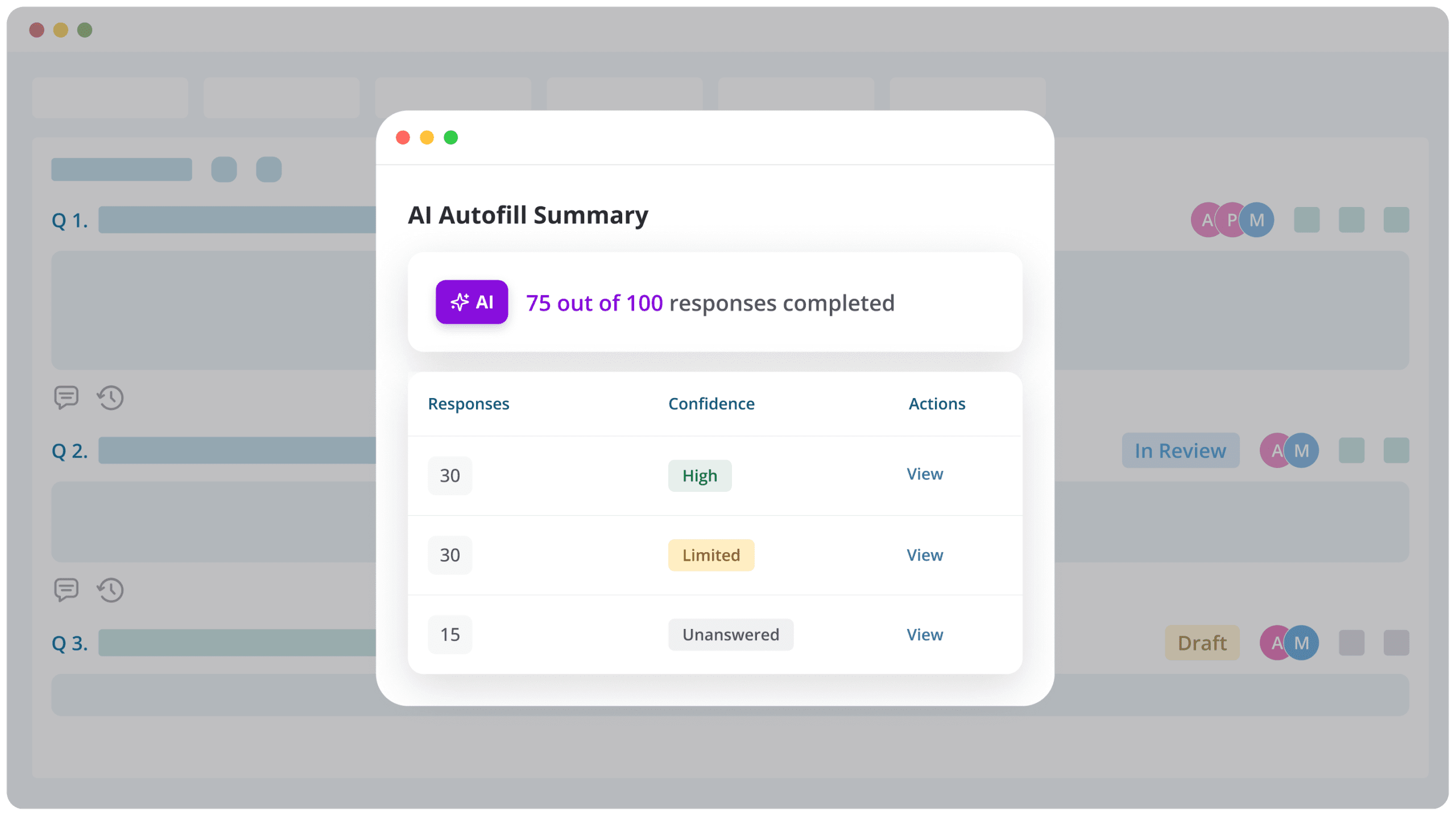

AI-powered Diligence

Integrate high quality AI workflows for fund document processing, DDQ autofill, memo generation, risk analysis, delivering efficiency at scale

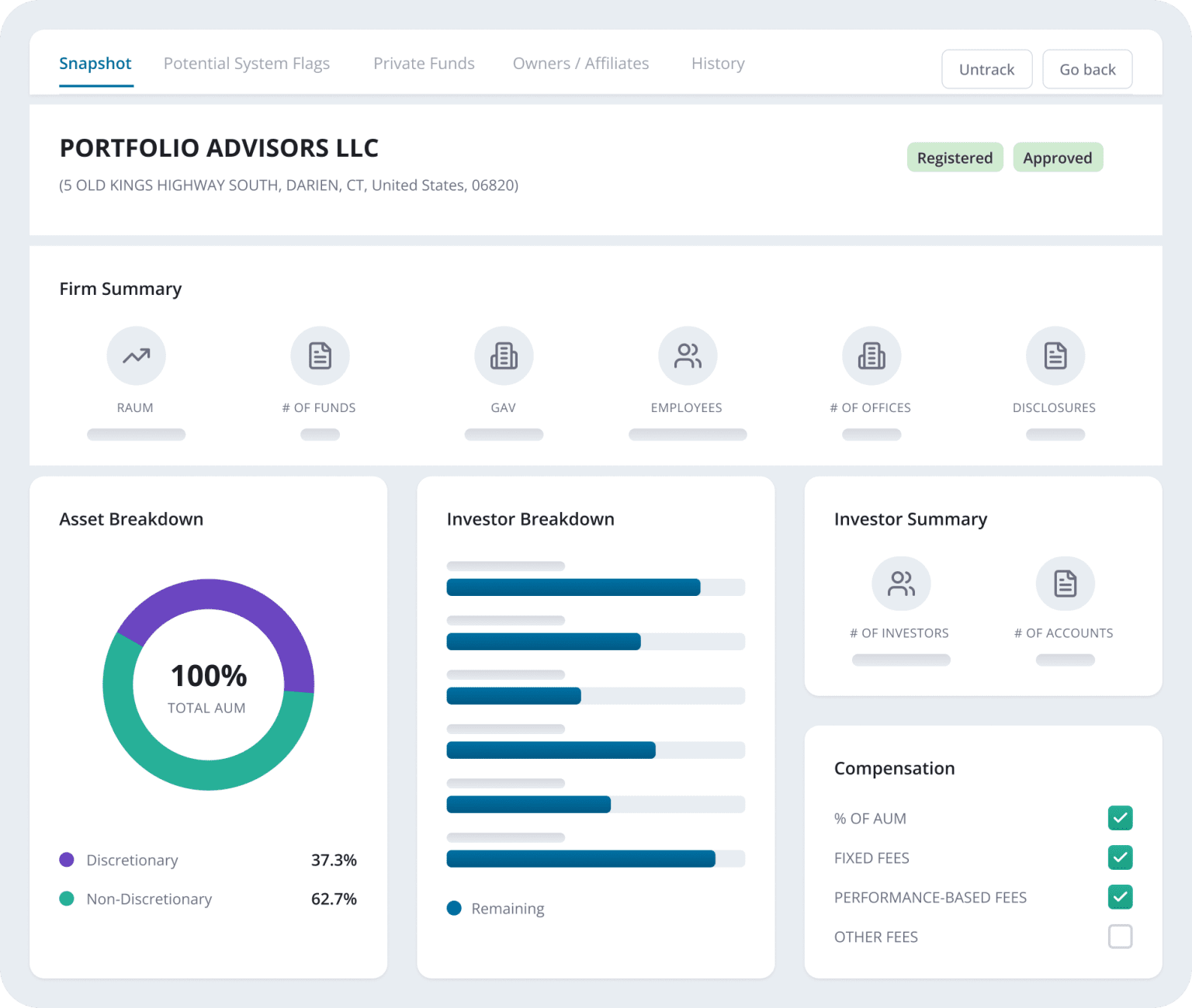

Analytics and Reporting

Real-time access to Form ADV filings, with smart profiles and change tracking

For Asset Managers

A central knowledge library and AI-powered automation for investor relations and marketing teams.

Institutional Knowledge Bank

Create and manage a content library, document repository, standard Blaze profiles and disclaimers.

Standard & Custom DDQs

Automate creation of standard DDQ using ILPA, AIMA, INREV standards, and respond to DDQ/RFPs with AI-powered workflows

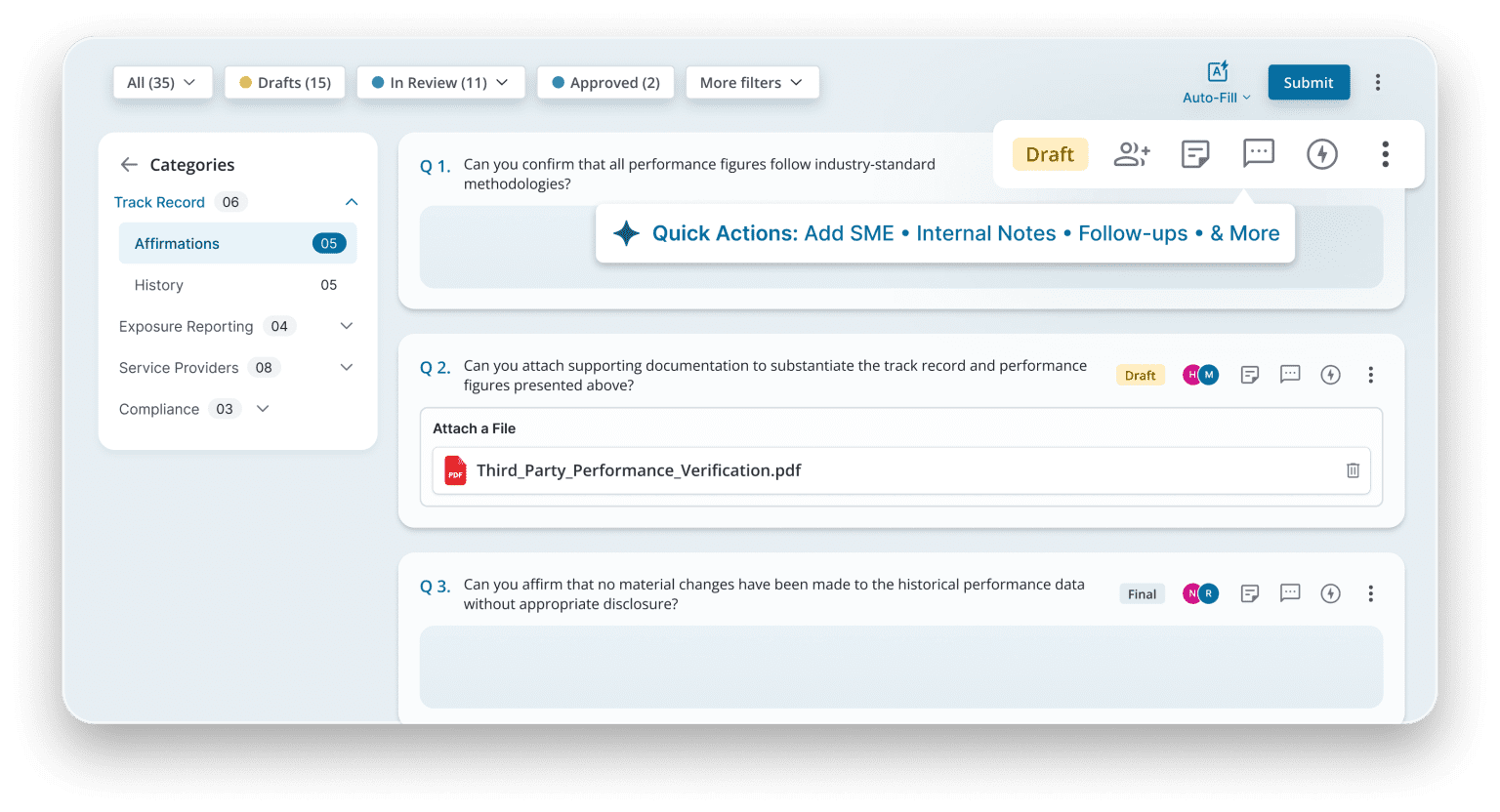

Compliance and Collaboration

Collaborate with your colleagues and enhance AI-powered compliance review

Investor Reporting and Distribution

Share Blaze profile, service provider details, standard DDQ with investors

Who Uses DiligenceVault

DV Spark is for allocators to power investment decisions with high trust data, consistency, and speed. Built to support sourcing, diligence and monitoring are key areas for manager research, ODD, ESG, compliance and legal teams, DiligenceVault offers a front to back solution.

- Plan Sponsors

- Family Offices

- FoFs, E&Fs

- OCIOs, ManCos

DV Pulse is the heartbeat of investor relations teams at asset managers. Modern content library, AI-powered autofill and investor content generation, collaborative workflows - delivering an all-in-one solution for investor engagement.

- Asset Managers

- GPs

-

Portfolio

Companies -

Fund Service

Providers

Go beyond with DV Exceed. Integrate industry solutions around Blaze standard data layer, service provider confirmation and Form ADV data insights - all on DiligenceVault's network.

-

Fund

Administrators - Auditors

- Consultants

-

Compliance

Partners

DiligenceVault By The Numbers

100K

Platform Users

82%

Increased Efficiency

113

Hours Saved / Diligence

150

Countries

What Our Clients Are Saying?

We really appreciate the collaboration amongst DV and other users and valued the knowledge sharing.

A Canadian insurance company client

We really appreciate the collaboration amongst DV and other users and valued the knowledge sharing.

A Canadian insurance company client

What's New at DiligenceVault?

Want to See How it Could Work for You?

Whether you’re an asset owner, consultant, RIA, OCIO or fund manager, see for yourself how DiligenceVault is changing how due diligence gets done. Sign up for a demo on the right and a Vaulter will get in touch shortly.